Expertise and advocacy: High Level Retreat on Financial Literacy AT - August 2022

From Saturday 27th to Monday 29th August, Financial Inclusion Europe’s executive director has been invited to share views and expertise during an exciting high level retreat on Financial Litercacy, which is part of the Lab Week 1.

Access to the European Forum Alpbach agenda

Expertise and advocacy: On 23 September, Financial Inclusion is one on three key topics to be discussed during the ESA Consumer protection day, centered on the way to facilitate the access for vulnerable groups of consumers

Draft programme – 3 sessions

11.00 – 12.20 SESSION 2. How to facilitate access to finance for consumers in an inclusive way in the current environment?

14.15 – 15.40 SESSION 3. What are the opportunities and challenges related to the access and sharing of data in financial services?

ACCESS to EIOPA webpage

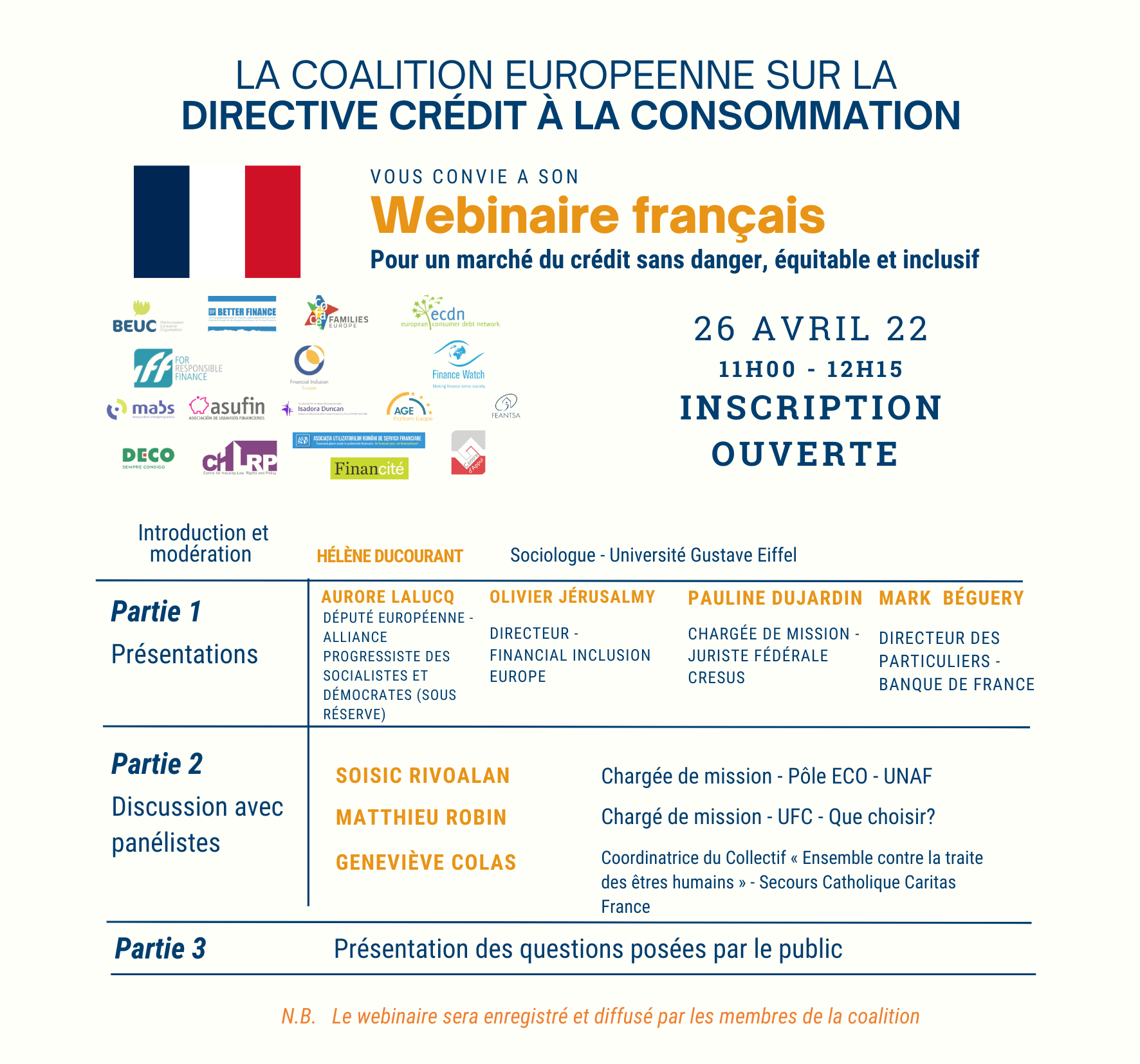

Webinaire français sur la Directive Crédit à la Consommation 26 April 2022 - Visionner l'enregistrement

Pendant 75 minutes, des acteurs clés des enjeux de la réglementation du crédit à la consommation ont débattu sur le nouveau projet de directive européenne et sur sa capacité d’apporter des réponses aux problèmes rencontrés sur le terrain.

Deutsches Webinar zur Verbraucherkreditrichtlinie - 27 April 2022 -

Unter Beteiligung von Dr. Helena Klinger und Dr. Duygu Damar findet am 27. April 2022 von 11:00 bis 12:15 Uhr das deutsche Webinar zum Thema Verbraucherkreditrichtlinie statt. Das deutsche Webinar wird von der CCD-Coalition organisiert. Die CCD-Coalition hat das Ziel, einen sicheren, fairen und integrativen Kreditmarkt zu unterstützen.

Das deutsche Webinar zum Entwurf für eine neue Verbraucherkreditrichtlinie wird zentrale Aspekte beleuchten, wie z.B. den Anwendungsbereich, die Kostenobergrenze, das Widerrufsrecht und den Zugang zu qualitativer Schuldnerberatung. Dabei werden kritische Fragestellungen diskutiert, z.B. wie die neue Richtlinie an die Verbraucher:innen in Deutschland und den deutschen Markt angepasst wird, und inwieweit die neue Richtlinie Innovation und verantwortungsvolle Kreditvergabe berücksichtigen wird, um Überschuldung zu bekämpfen?

Webinar Italiano : Direttiva sul Credito al Consumo - 28 April 2022

Una grande coalizione europea di ONG ha proposto misure per migliorare e rafforzare la proposta di revisione della Direttiva europea sul credito al consumo:

Per rendere il mercato del credito al consumo sicuro, equo e inclusivo.

Aumentare l’accesso al credito ai soggetti svantaggiati.

Ridurre i crediti deteriorati (NPL) e il sovraindebitamento.

L’evento prevede interventi di esperti di credito al consumo, seguiti da un un dibattito con attori rilevanti su questi temi. Ci sarà spazio anche per e domande del pubblico.

Documento d’opinione della coalizione

Past event - Irish webinar on the Consumer Credit Directive - 23 March 2022 - 11 am UCT

During this 75 minutes’ event, key stakeholders from Ireland will exchange on the CCD proposal and its capacity to improve the Irish consumer credit market to make it safer, fairer and inclusive.

An exciting discussion with Policy makers, Regulators, Researchers and Practitioners in the area of financial inclusion and consumer protection.

On-going activities - from June 2021 to...

Consumer Credit Directive - THE POLITICAL PRIORITY

A large Coalition of Civil Society Organisations to support our advocacy efforts:

Putting an end to dangerous consumer credit products and irresponsible lending practices: it is time to act now!

Join -us!

You are actively concerned by this topic, you want to act to prevent overindebtedness and ban exploitative credit practices, contact us to receive our material, opinion paper, and possible expertise and capacity building for you, your members, to act at EU and/or National level.

Coordinator – olivier.jerusalmy(at)gmail.com

Opinion paper

(download pdf)

Putting an end to dangerous consumer credit products and irresponsible lending practices: it is time to act now!

Introduction

Consumer credit can be a great tool for improving the lives of millions of European citizens. It makes it possible to carry out personal and family projects that would otherwise be very difficult, if not impossible to achieve: renovating one’s home, insulating it, purchasing electric cars when public transport is not easily accessible, and being able to face expenses that exceed one’s monthly budget and thus spread the payment over time.

At the same time, the use of consumer credit can also turn into a headache if not a nightmare when the product is not adapted to the consumer’s needs, contains hidden or excessive fees, or actively targets vulnerable consumers who will not be able to repay their loan without cutting into the family’s essential expenses and basic living needs.

The consumer credit market in Europe today presents features which are drivers of consumer harm.

there is no EU-wide ban on usury and no capping of excessive interest rates and consumer credit costs

creditors can grant the credit even when borrowers do not have the capacity to repay it

the creditworthiness assessment does not consider possible negative scenarios, such as possible increases in interest rates during the contract performance

consumers are not able to easily contest decisions based on credit scoring models and are not aware of the types of information considered to feed such models

with digitalisation and big data, it becomes increasingly easy to exploit consumers’ behavioural biases to make them sign a consumer credit contract which is not adapted to their individual and financial circumstances

consumer credit products are increasingly complex, personalised and sold online without necessarily being adapted to the consumer’s financial and personal situation

The positive impact of a safe consumer credit market on the EU economy

The Consumer Credit Directive was last amended in 2008, in the midst of the global financial crisis. Since then, there have been many changes in the way credit market serves consumers, with new products emerging on the market and the increased digitalisation of the sector. The CCD will benefit from a necessary update and ensure that lenders act responsibly and treat consumers fairly. Responsible lending practices can lead to many positive impacts on the economy:

Improving access to credit and qualitative inclusion: better risk assessment methods, based on an individual analysis of the borrowers’ creditworthiness are now made available thanks to open banking and artificial intelligence (AI). If regulated property, and limited to analysing the financial and/or economic data of consumers, such methods could lead to an enlarged and more adjusted credit offer (in size/in costs) that better fits the financial capacity and needs of consumers;

Increasing creditors’ financial resilience (credit institutions and other creditors) and limit risks related to the development non-performing loans (NPLs);

Shielding households from financial distress and over-indebtedness, thereby limiting social exclusion, unemployment, poverty, relationship breakdown, mental issues and an increased mortality rate which are all documented impacts of over-indebtedness.

Improvements stemming from the European Commission’s proposal

The Coalition welcomes the European Commission’s proposal to revise the Consumer Credit Directive (Directive 2008/48/EC). The new proposal, published at the end of June 2021, does bring a series of positive advances related to the protection of consumers in consumer credit markets.

The revised rules significantly broaden the scope of products that will need to comply with stricter lending obligations. They will include small loans below €200, loans offered through crowd-lending platforms (online financing that connects people willing to loan money to those looking for funding) and ‘buy-now-pay-later’ products increasingly offered to consumers online.

The Commission also proposes to limit the sometimes-egregious costs of consumer loans, by requiring countries to cap interest rates and/or the total cost of credit. This is already common practice in several EU countries, protecting consumers from predatory loans.

More needs to be done to achieve a resilient and safe consumer credit market

The Commission’s revised proposal, although substantially improved, still suffers from shortcomings. The objective of tackling bad debt and over-indebtedness is not fully addressed: yet these challenges have been widely documented in recent years, despite the lack of sufficient statistical data.

The advances proposed do not go far enough and will not prevent the marketing of consumer credit to households that are unable to manage the repayments.

The digitalisation of financial services is still rapidly expanding, and regulation should be designed to foresee and prevent any major detriment for consumer credit users, in particular for the most vulnerable consumers in the EU.

To achieve the key objectives of limiting the risk of irresponsible lending practices that generate public expenditures and societal costs as well as over-indebtedness, the Coalition advocates for, amongst others, the following improvements and amendments to the European Commission’s draft proposal:

Ban marketing practices (advertising and offers) which push consumers towards consumer credit products they cannot afford nor reimburse in due time.

The EU should require all EU Member States to implement caps on the Annual Percentage Rate of Charge (APRC), and implement a common EU calculation method to limit the egregious costs of certain consumer loan products. The business model of certain lenders is to charge very high interest rates for most consumers, to cover the risk of default of some. As a result, short-term high-cost loans are often extended to vulnerable consumers who cannot respect terms and conditions in a way that increases the profit of the creditors.

Require creditors to have product oversight and governance policies in place, and to only distribute credit products to a suitable target market.

Ensure that pre-contractual information is clear, understandable, timely, and that easy and simple consumer credit choice is facilitated.

Guarantee a qualitative creditworthiness assessment which takes into account the consumer’s household budget and living expenses to limit undue exclusion

Ensure that consumers are properly informed regarding the categories of data that are used to assess their creditworthiness and ensure that they can effectively contest credit decisions, in particular when artificial intelligence is used

Ensure that possible negative scenarios and changes in terms and conditions are considered at the moment of assessing the consumer’s creditworthiness remain compatible with it, including variations in interest rates

Take measures to ensure that the exercise of the consumer’s right of withdrawal is easy and possible in practice, in particular when dynamic and persuasive selling techniques have been used, in linked credit agreements

Establish an obligation for creditors to detect financial difficulties early and to grant appropriate forbearance measures to distressed consumer borrowers

Provide consumers in difficulties with immediate and personalised debt-advice solutions to limit the risk of over-indebtedness and to allow a quick budget recovery, ensuring at all times that repayments do not impinge on reasonable living expenses, at such a level as to permit full participation of the debtor in society with dignity

Require the European Banking Authority to design and collect indicators to measure the quality of consumer credits market and carry out precise NPL monitoring, including information on:

Default rate by type of credit and by lender: this ratio, which is easy to collect by national competent authorities, would make it possible to quickly identify lenders whose business model is based on a higher rate of repayment accidents

Default rate and sales channel:was the sale made by an intermediary, or online, or in a store? This information is essential for regulators to ensure that all sales methods are safe and guarantee the proper information and decision-making of both the seller and the buyer

In order to achieve the EU’s climate goals and accelerate the green transition, the Coalition also advocates for the development of standardised green loan offers (to finance energy efficient equipment & home improvements), setting a stricter cap on green loans, and specific guarantees to ensure that the most vulnerable consumers can also access green financing.

It is our duty, as NGOs defending the rights and interests of European citizens and consumers, to advocate for these improvements to be implemented in the revised Consumer Credit Directive.

A new proposal by the Commission

End of June 2021, the EU Commission presented its new proposal for an updated version of the Consumer Credit Directive (CCD).

Access hereWe point out the very important improvements here:

The Consumer Credit Directive was last amended in 2008, in the midst of the global financial crisis. Since then, there have been many changes in the way credit market serves consumers, with new products emerging on the market and the increased digitalisation of the sector. The CCD will benefit from a necessary update and ensure that lenders act responsibly and treat consumers fairly. Responsible lending practices can lead to many positive impacts on the economy:- Improving access to credit and qualitative inclusion: better risk assessment methods, based on an individual analysis of the borrowers’ creditworthiness are now made available thanks to open banking and artificial intelligence (AI). If regulated property, and limited to analysing the financial and/or economic data of consumers, such methods could lead to an enlarged and more adjusted credit offer (in size/in costs) that better fits the financial capacity and needs of consumers;

- Increasing creditors’ financial resilience (credit institutions and other creditors) and limit risks related to the development non-performing loans (NPLs);

- Shielding households from financial distress and over-indebtedness, thereby limiting social exclusion, unemployment, poverty, relationship breakdown, mental issues and an increased mortality rate which are all documented impacts of over-indebtedness.

- Decreasing public expenditures (health care, unemployment and other social allowances, budget and debt advice) and shielding over-indebted people from lengthy economic and social rehabilitation ghostwriting.

- Increasing public incomes (e.g.:VAT) – as over-indebted consumers consume less during a long lasting reimbursement scheme, which means less tax perceived on such consumption.

Some key improvements which remain to be made

To achieve the key objectives of limiting the risk of irresponsible lending practices that generate public expenditures and societal costs as well as over-indebtedness, the Coalition advocates for, amongst others, the following improvements and amendments to the European Commission’s draft proposal:

- Ban marketing practices (advertising and offers) which push consumers towards consumer credit products they cannot afford nor reimburse in due time.

- The business model of certain lenders is to charge very high interest rates for most consumers, to cover the risk of default of some. As a result, short-term high-cost loans are often extended to vulnerable consumers who cannot respect terms and conditions in a way that increases the profit of the creditors. The EU should require all EU Member States to implement caps on the Annual Percentage Rate of Charge (APRC), and implement a common EU calculation method to limit the egregious costs of certain consumer loan products.

- Require creditors to have product oversight and governance policies in place, and to only distribute credit products to a suitable target market.

- Ensure that pre-contractual information is clear, understandable, timely, and that easy and simple consumer credit choice is facilitated.

- Guarantee a qualitative creditworthiness assessment which takes into account the consumer’s household budget and living expenses to limit undue exclusion

- Ensure that consumers are properly informed regarding the categories of data that are used to assess their creditworthiness and ensure that they can effectively contest credit decisions, in particular when artificial intelligence is used

- Ensure that possible negative scenarios and changes in terms and conditions are considered at the moment of assessing the consumer’s creditworthiness remain compatible with it, including variations in interest rates

- Take measures to ensure that the exercise of the consumer’s right of withdrawal is easy and possible in practice, in particular when dynamic and persuasive selling techniques have been used, in linked credit agreements

- Establish an obligation for creditors to detect financial difficulties early and to grant appropriate forbearance measures to distressed consumer borrowers

- Provide consumers in difficulties with immediate and personalised debt-advice solutions to limit the risk of over-indebtedness and to allow a quick budget recovery, ensuring at all times that repayments do not impinge on reasonable living expenses, at such a level as to permit full participation of the debtor in society with dignity

- Require the European Banking Authority to design and collect indicators to measure the quality of the consumer credits market and carry out precise NPL monitoring, including information on:

- Default rate by type of credit and by lender: this ratio, which is easy to collect by national competent authorities, would make it possible to quickly identify lenders whose business model is based on a higher rate of repayment accidents

Default rate and sales channel: was the sale made by an intermediary, or online, or in a store? This information is essential for regulators to ensure that all sales methods are safe and guarantee the proper information and decision-making of both the seller and the buyer